As a property developer, you always need to be aware of potential hazards in areas that you’re operating in. And if you’re based in Florida, it’s likely that you’ll have to tread particularly carefully.

Different states have different constraints that developers should focus on – like, earthquakes in California, or landslides in the North West.

These constraints all affect where you can build and checking these out is an essential step in your early due diligence.

What property hazard risks does Florida have?

As a coastal state, Florida has its fair share of hazards. Namely, flood zones, hurricanes and wetlands.

Below, we break down what these are – and the impact they can have on developers.

Florida flood zones

Due to Florida’s geography, large swathes of land fall under flood zones. But, there are different hazard risk gradings to be aware of.

- Zones V, V1-30, VE (High risk coastal) – 1% annual chance of flooding. Regulatory floodways.

- Zones A, AE, A1-30, AH, AR & A99 (High risk) – 1% annual chance of flooding. Regulatory and Special floodways.

- Zones X and B (Moderate risk) – 0.2% annual chance of flooding.

- Zones C and X (Minimal risk) – future conditions 1% annual chance of flooding or area with reduced risk due to levee.

- Zone D (Unknown risk).

High risk flood zones in Florida often result in higher building standards and require specific Base Flood Evaluation (BFE) or Design Flood Evaluation (DFE). Not to mention flood insurance.

Specialized construction materials may also be required – with the potential to increase build costs.

Florida wetlands

Over 31% of Florida is made up of Wetlands. Wetlands include various land types, including swamps, marshes, bogs and wet prairies.

And with this abundance of constrained land, it’s only natural that developers often ask can you build on wetlands in Florida?

Some wetlands are not only nearly impossible to build on due to the instability of the land but are often protected due to the wide variety of wildlife that live there. They also play a vital role in preventing flooding.

However, in certain situations, permits can be granted to build on wetlands with the relevant scoring.

This scoring is then used to determine whether mitigation is required or not.

Hurricanes

Florida also experiences more hurricanes than any other state (or has since the Saffir/Simpson scale started to be used in 1851). In fact, it had nearly double that of Texas – the second most impacted state.

Similar to flooding, certain areas of Florida are more susceptible to hurricanes and developers will need to take this into consideration when looking to build homes in these regions.

More robust materials may be needed to protect the building from hurricane damage and often higher insurance premiums will be required.

How do hazards impact developers?

Developers need to be aware of prominent hazards in their area which may impede or complicate the delivery of housing.

Using a Florida flood zone map or map of Florida wetlands is an important starting point for understanding your local terrain. As well as familiarizing yourself with the regulation and mitigation that is required for these hazards.

Hazards can have a limiting effect on where you can source opportunities and further narrow your search criteria.

They can also be costly to navigate. You may need to spend more on specialized materials to safeguard your development or on mitigation.

Insurance premiums also play a huge role in your development costs.

Insurance premiums

The severe bout of hurricanes in 2004-2005 was the start of insurance costs rising significantly for homeowners in florida. In June/July 2023, they were the highest in the country – at four times the national average.

Hazard insurance in Florida (including flood and hurricane insurance) is often an additional cost on top of homeowner insurance.

Although as a developer, you don't have to bear the costs directly, it’s likely to influence your sales prices. Home buyers are aware of the inflated costs they’ll need to pay on their insurance so will be looking to get the best deal possible on the property itself.

In more extreme conditions, it may drive down demand entirely as consumers may not have the risk appetite or finances to be able to fund a heftier insurance premium.

How can LandTech help?

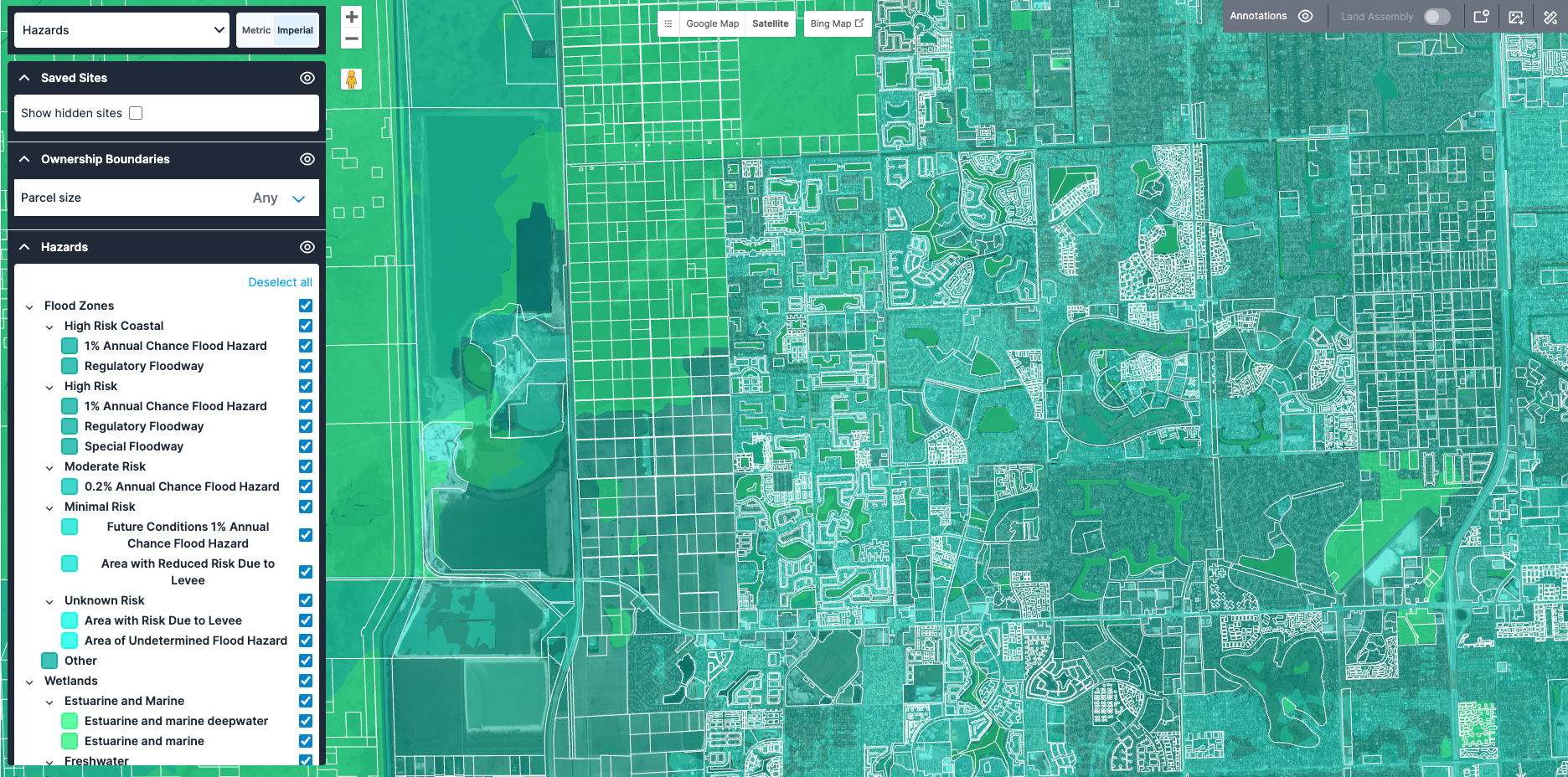

LandTech is our site-sourcing and pipeline management tool and provides key information into hazards in Florida.

Our property hazard risk data has a flood zone map and wetland map for Florida – giving you an instant overview of which land in your target area is impacted by hazards. Click on any parcel of land to see further information, including:

For Flood zones –

- Flood zone unique ID

- Study type

- Zone label

- Zone name

For Wetlands –

- Class definition

- Class name

- Split class definition

- Split class name

- Split subclass definition

- Split subclass name

- Subclass definition

- Subclass name

- Subsystem definition

- Subsystem name

- System definition

- System name

- Water regime definition

- Water regime name

- Wetland code

- Wetland name

- Wetland type

All this data at your fingertips helps you to make more informed decisions about where you want to develop.

Combined with zoning, ownership, comparables, and demographic data, you won’t even have to leave LandTech to complete any of your site sourcing or due diligence tasks.

Even better – we also have a property development pipeline tool to help you easily manage and visualize all your opportunities across each stage of the development lifecycle.